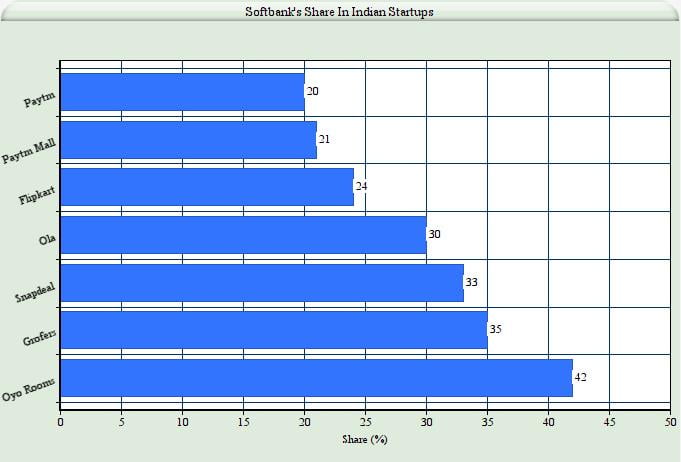

SoftBank has an undeniably dominant position in the Indian startups, as claimed by a report in The Times of India. Its way of functioning can be understood when we take a close look at the startups SoftBank has invested in.

Grofers and SoftBank

Online grocery delivery startup Grofers recently raised $60 million in a funding round led by existing investors, with the exception of its first institutional backer, Sequoia Capital. SoftBank, while investing has taken care to see that the rights favour SoftBank.

It controls around 35% in Grofers, struck the deal in a way that gave preferential rights to investors in the latest round of funding.

The investors in the last fund-raise also ended up getting a significant say in matters related to the sale of the company, which can no longer be blocked by its founders. Grofers closed its latest financing, valuing it at $260 million pre-money, which was a down round.

Ola and SoftBank

It was only last year when Tiger Global, the New York-based investment fund which owns large chunks in India’s top internet companies, wanted to partially sell its shares in the ride-hailing major Ola to the most influential technology investor globally, SoftBank.

The negotiations between the two global giants were taking place without the knowledge of Ola CEO and co-founder, Bhavish Aggarwal.

Aggarwal resisted the transfer of shares through a right that gives the Ola founders the power to veto the transfer of shares among two investors.

Aggarwal went ahead and blocked the transaction. In fact, the 33-year-old is now working towards creating a special purpose vehicle or SPV, which would have separate legal rights, to facilitate a secondary sale of shares at the cab aggregator.

Aggarwal wants to own the highest voting rights, even as a minority shareholder, to avert any situation where shares change hands without the founder’s go-ahead. His moves come on the back of a possible merger that SoftBank may want to pull off between Ola and Uber, where it holds a stake of more than 15%.

Oyo and SoftBank

SoftBank stepped in and wrote a $60-million cheque for Oyo in a flat round in 2016 valuing the Gurgaon-based startup at around $400 million. The company yet again offered $500 million to Oyo in 2017.

However, the problem arose when early investors in Oyo like Lightspeed Venture Partners and Sequoia Capital opposed this massive capital infusion, which would have diluted their shareholding. Finally, Oyo halved the fund-raise, picking up only $250 million from the SoftBank Vision Fund with $25 million coming from the family office of Hero Group.

In 2018, SoftBank is back in play, with an offer to pump $1 billion into Oyo.

Flipkart had a different experience with SoftBank

Having come in last year with a 23-24% stake in the Indian e-commerce major, it has not been able to steer the ongoing deal with Walmart single-handedly. If the deal goes through, the American retailer will get a majority control at Flipkart. Sources say SoftBank is up against older investors in the company like Naspers and Tiger Global, among others. The SoftBank CEO would have wanted to consolidate the online shopping market, bringing together Flipkart, Alibaba and Paytm, which seems unlikely with Walmart’s entry.

Founders are left with hardly any options

Investors and founders have pointed out that they do not have much choice because these companies did not have an option to tweak the contours of the deal, considering that no one else was shelling out the required capital. They have also pointed out that the Japanese firm is not going to bring in a substitute for the senior executive because it knows that entrepreneurs are required to carry out the business.

At this point, it’s the decision of taking the cash or letting it go to its competitors. Another venture capitalist at a global fund says the most significant impact of SoftBank and its money power has been on smaller shareholders who have become irrelevant on the cap table. The company strategy is pushed in a direction that uses more capital, which may or may not had been the original plan.

But SoftBank has been the source of secondary transactions, helping exit-starved VCs shore up returns from companies like Flipkart and Paytm, which still remain private.

Conclusion

With companies like China’s Tencent, Alibaba, as well as South Africa’s media & internet group Naspers backing some of the bigger e-startups, there could be a shift in the balance of power towards the founders and companies in India, some industry experts say.

Experts also feel that SoftBank’s investment in India might be way ahead of time.India isn’t likely to be China any time soon. China was $500 per capita income 15 years ago and is $10,000 today. India is $2,000 today and will go to $4,500 in 10 years. Hence, they are pushing companies to go outside India, merge with their competitors, and consolidate the market.

Also Read: Common shareholder SoftBank calls for merger between Uber, Ola in India