Continuing its rapid decline, the rupee has weakened by another 23 paise against the dollar to trade at the life-time low of 70.82 on strong month-end demand for the US currency between the sustained foreign fund outflows. At the Interbank Foreign Exchange (Forex) market, the local currency opened a tad higher at 70.57 a dollar from its previous close of 70.59 but slipped to hit a fresh low of 70.82, down by 23 paise.

Forex dealers said apart from the strong month-end demand for the American currency, buying by the importers, mainly the oil refiners in the view of surging crude oil prices and the capital outflows, weighed on the domestic currency. Furthermore, the dollar strength against its rival currencies overseas too put pressure on the rupee, they said.

The rupee had recorded a steep fall of 49 paise, to close at record low of 70.59 against the dollar in the previous session. Meanwhile, the BSE Sensex recovered by 96.13 points, or 0.24 per cent, to 38,819.06 in early trade. The Indian rupee today weakened to new all-time lows against the US dollar, tracking losses from Asian currency market. At 2 pm, the rupee was trading at 70.78 a dollar, down 0.26% from its previous close of 70.59. The currency today opened at 70.69 a dollar and touched a fresh all-time low of 70.82 a dollar and a high of 70.59. According to traders, dollar sale, on behalf of the central bank, pulled the rupee back from the day’s low before it weakened again.

ALSO READ: Cognizant Expands Operations In Texas

The 10-year bond yield stood at 7.929%, from its Wednesday’s close of 7.918%. Bond yields and prices move in opposite directions. Bank of America in a note on Wednesday said India’s sovereign bonds may be under pressure as oil hold gains near the highest level in a month. The Sensex lost 0.21% or 81.17 points to 38641.76 in afternoon trade. Since January, it has gained 13.46%. Bank of America Merrill Lynch in the note, which was released yesterday, says that it is confident that the government will use its surplus balances with the RBI to fund fiscal slippage.

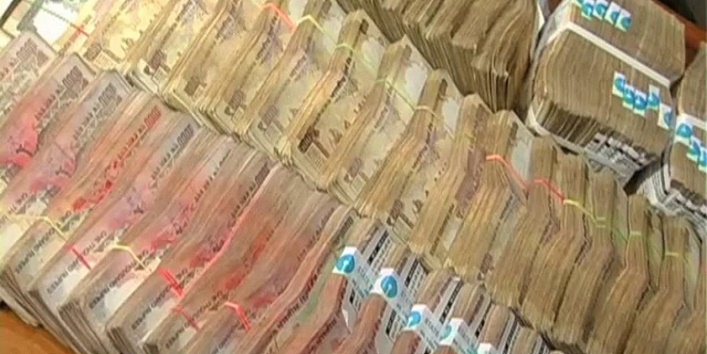

Surplus cash balance rose to Rs 1.7 trillion as of March, 2018 from Rs 1.3 trillion last year. Economic Affairs Secretary Subhash Chandra Garg in a news briefing said, “India’s cash ban measure achieved its objective substantially.” RBI’s annual report showed 99.3% or Rs 15.3 trillion of the bank notes were returned. So far this year, the rupee has weakened 9.75%, the worst performer among Asian currencies. Foreign investors have sold $256.45 million and $7.96 billion in equity and debt markets, respectively.

Asian currencies were trading lower. China renminbi lost 0.241, China Offshore 0.355%, Philippine Peso 0.138%, Thai Baht 0.092%, Indonesian Rupiah 0.068%, Singapore Dollar 0.132% and Malaysian Ringgit 0.097% and Hong Kong Dollar 0.009%. The dollar index, which measures the US currency’s strength against major currencies, was trading at 94.665, up 0.07% from its previous close of 94.60.

The dollar strength against its rival currencies overseas too put pressure on the rupee, Forex dealers said. The rupee’s fall against the dollar continued with the currency hitting fresh lows against the dollar for the second straight day.

ALSO READ: DIPP rules out 49% FDI in inventory model, new Ecommerce policy likely to come out soon