In the first half of the financial year (April-September 2020), the Indian government will borrow Rs 4.88 lakh crore. This amount is 62.56 per cent of the borrowing target set for the entire financial year. This money will be borrowed through the gross market in the first six months of FY ending March 2021.

The decision arrives amid the government battling the coronavirus crisis and relieves the economic influence of the pandemic.

The Indian government intends to circulate bonds worth 190 billion rupees to 210 billion rupees. These bonds will get issued weekly through the first six months of the fiscal year that begins on April 1. There was an expectation that India would lower its borrowings in April 2020. But the announcement by the Indian government reveals more aggressive lending compared to last year.

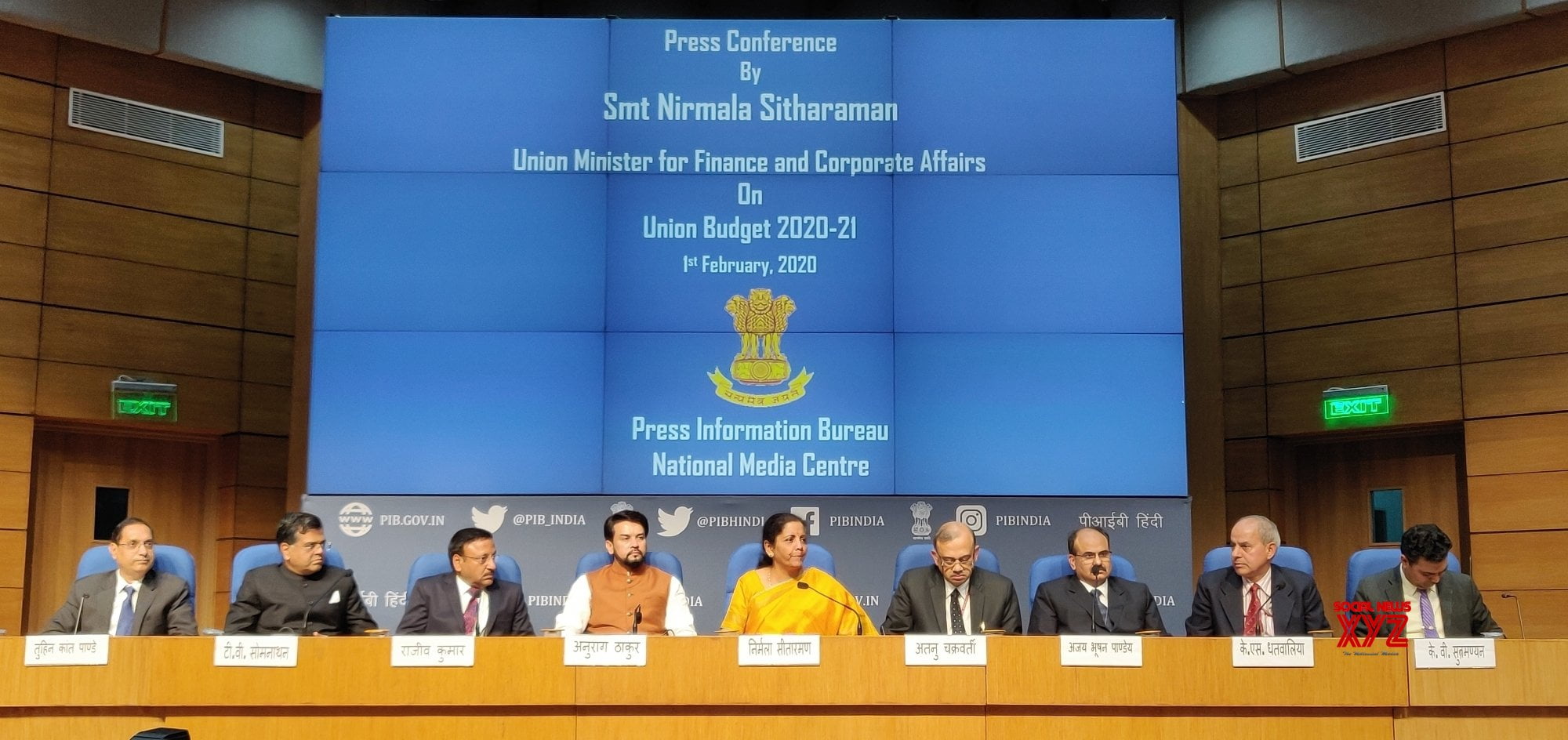

Economic Affairs Secretary Atanu Chakraborty stated “Government shall do whatever is required to do for the resurgence and recovery of the industries. Our fund-raising resources not only from the markets but also from multilateral agencies, are geared towards that.” A few days ago, Nirmala Sitharaman ( Finance Minister) declared a package of 1.7 trillion rupees to help the poor at the time of coronavirus pandemic. At the same time, the RBI reduced its benchmark rates by 75 basis points and proclaimed a host of liquidity measures.

Furthermore, the government raises funds from the market to meet its fiscal deficit. For this, term bonds and treasury bills get issued. In the budget of 2020-2021, the government’s fiscal deficit is estimated to be Rs 7.96 lakh crore. In addition, this estimated fiscal deficit will be 3.5 per cent of the GDP.

RBI also initiated a new division of bonds in which foreign investors can purchase 5-, 10- and 30-year bonds. Above all, this fresh issuance of bonds by RBI would assist in shoring up demand for bonds in the market.