Do you know the feature that enables one to transfer money from one e-wallet to another. It is the feature that the central bank’s interoperability guidelines for prepaid payment instruments like e-wallets will enable.

Most of the times when we go out with our colleagues or friends for lunch or dinner we usually split the bill. On person pays the bill and others either pay him via Paytm or some other mode.

Those include Mobikwik or Oxigen instead, end up withdrawing cash from a nearby ATM to pay their share, or do a bank transfer. This was because you cannot transfer money from one e-wallet to another as of now.

ALSO READ: BMW To Recall 1 Million Cars Globally Over Fire Hazard

But this will change soo . The Reserve Bank Of India has now issued the guidelines on th interoperability of the prepaid payment instruments like the e-wallets om 16th Oct9ber that will enable money transfer from one e-wallet to another apart from offering the other benefits.

Whenever, PPI implements the guidelines, like the e-wallets there is no need of having multiple accounts with various e-wallets just because the specific services accept the payments only through one e-wallet.

For example, previously, Uber did allow Paytm as a payment option for those who wished to make the pay via e-wallets. In the same way, Ola allows only through Ola Money to be used for the payments through the e-wallets.

The e-wallet account functions like a bank account in ways for the digital payments those include having a Rupay or Visa or the MasterCard of its ow issued by the e-wallet company.

One can also transfer the funds to the othrr e-wallets or bank accounts or can evan make the payment for any of the services either online or through point of sale (PoS) terminals or swipe machines at retail outlets.

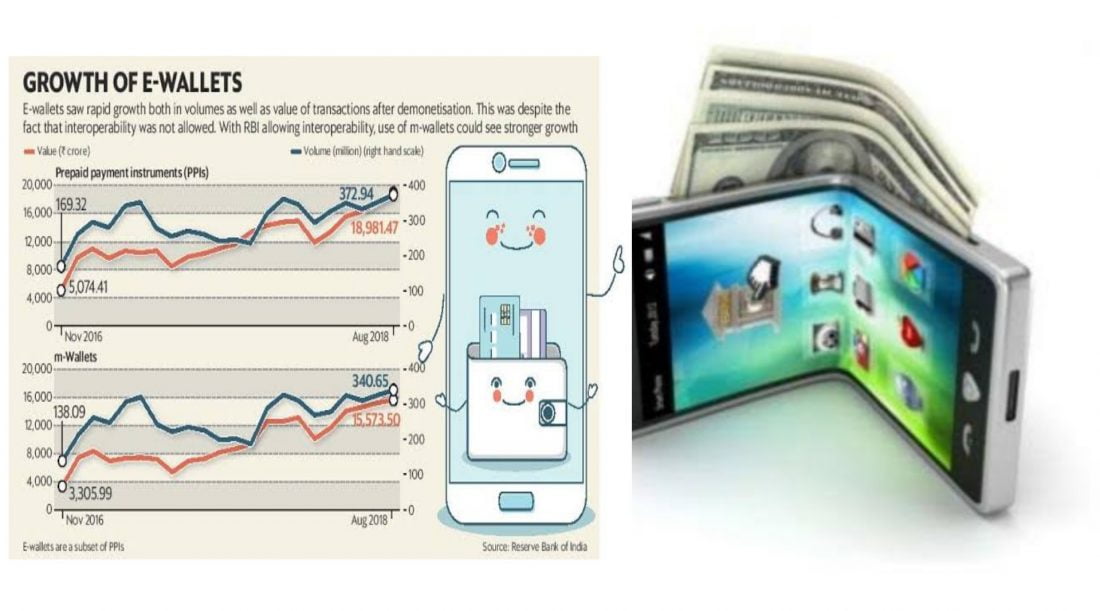

There are also other forms of PPIs like the meal vouchers and the gift cards, the mobile wallets those make 91% of the PPI transaction volume and 82% of the PPi transaction value.

Here are the three main takeaways for an average digital services and digital payments consumer.

One e-wallet for all services

For those who use digital payments, this is the biggest takeaway. Going ahead, you don’t need to use the particular e-wallet just because thr can aggregator has a tie up with the particular e- wallet company.

“Theoretically, you will not need more than one KYC-compliant e-wallet just to avail some service. But in reality, people would still keep more than one, just like debit or credit cards. For acceptance, everyone will be on a level playing field now. What the e-wallets will have to compete for now will be the service quality, special features and maybe some offers,” said Navin Surya, chairman, IAMAI’s Fintech Convergence Council.

The acceptance of all the e-wallets across the ecosystem, seamlessly, the way it happens for debit or credit cards, is the game changing aspect of the recent guidelines, Surya said.

E-wallet Cards with limited exposure

The latest guidelines of RBI have enablec the prepaid payment instruments those include e-wallets for joining the card networks. As there are more than 900 million debit and more than 300 million credit cards in India, only 50-60 million cards are used on the e-commerce platforms.

“The enablement of card issuance by PPIs is a very big step towards enabling a customer to use a card which has a stored value and which can be used just like a debit card. So today if you have ₹10,000 in a savings account, you can put ₹1,000 in your e-wallet card, and use that card on any online medium as if you are using a debit card. But now the risk is low and you are not exposing your bank account,” Kulkarni said.

Your e-wallet account don’t have any repetitive balance coming automatically every month as it is not the salary bank account. Even if some one ends up compromising the e-wallet card details, the account stake remains limited as the card is not linked directly to the bank account.

On the other hand, you always need to be very careful about the various digital frauds when using the e-wallet. The complete KYC-compliant e-wallet accounts can store up to ₹1 lakh presently.