The news updates about the Flipkart-Walmart deal and Amazon’s interest in playing a significant role in it has been selling like hotcakes. Over the recent weeks, media reports have suggested that retail major Walmart and e-commerce behemoth Amazon is battling hard to acquire a majority stake in Bengaluru-based Flipkart. Currently, Japan’s Softbank is the largest investor in the company.

Reuters had reported last week that Bentonville, Arkansas-based retail giant, Walmart has completed its due diligence on Flipkart and had made a proposal to buy 51 percent or more of the Indian company for between $10 billion to $12 billion. As per the news agency, the proposed deal is due to be closed by the end of June.

It is at the same time that Seattle-based e-commerce major Amazon, too, is trying to acquire a significant stake in the Indian e-retail major, Flipkart. Amazon has even offered a breakup fee of $2 billion. A breakup fee is a penalty set during the process of takeover agreements, to be paid if the target backs out of the deal.

The breakup fee drives home the seriousness of the deal between Walmart and Flipkart.

Although none of the stakeholders in the deal have commented on this deal, it is for sure going to be a momentous one in the history of Indian e-commerce.

Why Flipkart?

In spite of its losses, Flipkart is widely considered one of the most successful Indian startups. Therefore, holding a controlling stake in the company can go a long way in ensuring a win in the Indian retail space.

For one, Flipkart is the world’s third-most funded private company, having the backing of global investors such as Softbank, Tiger Global, DST Global, Morgan Stanley, and Accel Partners, among others.

It was founded in 2008 by IIT-Delhi alumni Sachin Bansal and Binny Bansal and is the most valued Indian internet business with a valuation of over $15 billion.

The company has made at least 10 acquisitions in the 10 years of its existence. Its purchases include online lifestyle retailers Myntra and Jabong which have made Flipkart a leader in the segment by a wide margin. The firm is a source of employment for 8000 permanent employees and 20,000 contract workers.

Flipkart was the first one to introduce ‘cash-on-delivery’ options and has proved its worth after Snapdeal failed in 2017.

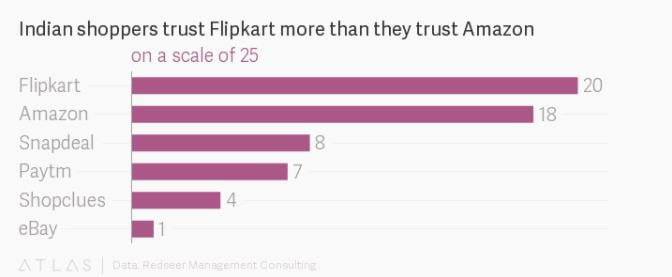

Flipkart has a higher level of trust among Indian shoppers as compared to even Amazon, according to a December survey by e-commerce advisory firm RedSeer Consulting.

Flipkart and Walmart

Despite having entered India over a decade ago, Walmart’s presence in the country has been limited to just around 20 business-to-business stores, owing to the government’s restrictive policies and failed attempts at joint ventures.

Striking a deal with Flipkart would enable Walmart to establish itself in India’s $670 billion retail markets.

Walmart is the world’s largest traditional retailer, but Amazon has proved a stiff competition as consumers increasingly migrate to online retail. India is the next big potential prize after the US and China. Foreign investors have not made much progress against the Alibaba Group Holding Ltd. in the country. The market here is not that cutthroat and Walmart has several new strategies up its sleeves to woo customers in India.

Flipkart also stands to gain from the over $3 trillion Walmart’s retail experience of more than 50 years in the US.

If this deal gets finalised, Flipkart will have an investor who understands retail and has done it at scale.

Flipkart and Amazon

The two companies have fought an epic battle for supremacy over the last five years, from teasing each other to taking pot shots and from poaching talent to lobbying the government. Yet, neither is close to being a clear winner.

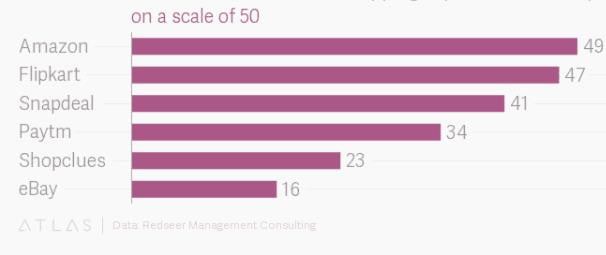

While Flipkart wins on some parameters, Amazon is ahead on others. For instance, while Indian shoppers trust Flipkart more than Amazon, the shopping experience on the latter is deemed better.

Experts think that if a deal is struck between the two companies they should join hands to work towards making business more profitable.

Amazon’s potential willingness to pay for Flipkart might be because it might have thought that a combined Amazon and Flipkart would lead to a less competitive or more rational environment going forward. It could also enable Amazon to scale its budding logistics network faster and more profitably, e

But, Flipkart’s co-founders, once Amazon employees, are likely to opt for Walmart as a potential investor as that will allow them to continue leading the company. And even if Amazon does buy a stake in Flipkart, it could face regulatory challenges as the combined entity will be a dominant player and may trigger anti-competition issues.

However, with none of the stakeholders coming out in open and explaining their stance, we just sit back and watch for the country’s biggest e-commerce battle to unfold.

Also Read: Flipkart Says It Can’t Pay Tax On Fictional Income, Appeals Against 110 Crore Tax Demand