Apple has launched three new subscription services at the Apple Event held in California, USA. Apple has launched Apple TV +, Apple Arcade (Gaming Bundle), all-you-can-read Magazine subscription, and Apple Credit Card with Partnership of Goldman Sachs. The most amazing subscription launched by Apple was its all-new titanium credit card. This has amazed apple fans right now and becoming a hot topic on social media to discuss on.

Apple has also launched an offbeat type of credit card in partnership with Goldman Sachs. The special thing about this credit card is that it is made of titanium. Apple Card users will also be able to find out how much amount has been spent and how much to pay, through the wallet app in their iPhone or other Apple devices. This application by Apple will give a detailed description of the amount you spent, in which you will get information on the cost of the category.

Apart from this, card users will also get daily Cash Rewards in various ways in Apple Card. If a user changes his address, then it can be done just through a simple text message. Apple has taken special care of users’ privacy in this card. The company said that neither Apple nor Goldman Sachs will use the personal data of users for any type of advertising or sharing information with any other third party.

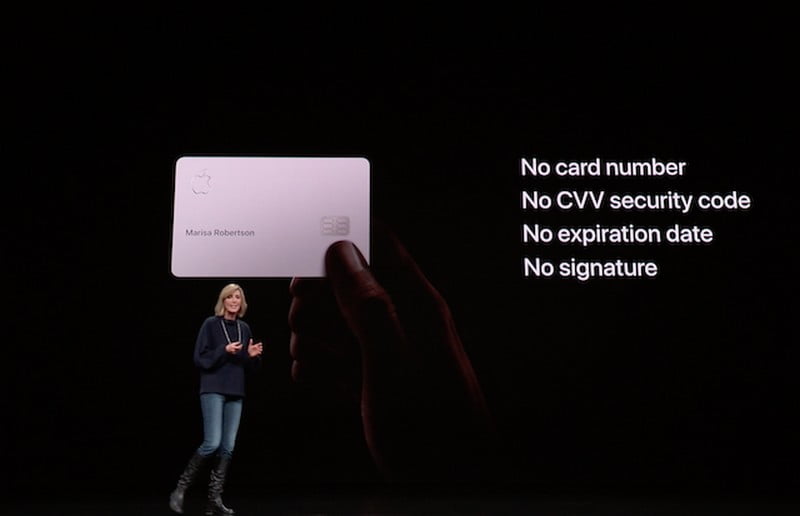

The company has said that the Apple Card going to be available in the US this year will offer a more clear rewards program compared to other credit cards. Those who want to get it can take it from the iPhone’s iTunes or wallet application. Customers will receive a fixed amount of daily cash on each purchase from Apple Card. With Apple Pay, every time users use the card, the person will get 2 percent daily cashback. Shopping through Apple Store, App Store, and Apple Services will get the users 3% cash back on every purchase. Interestingly, there will be no number on this card and neither CVV nor any details.

Apple claims that this Apple Card will completely change the credit card usage experience. The company has said that the application process for getting this card will be very easy. Though this card, customers will be motivated to pay less interest. Also, the new level of high privacy-security will be enabled. Customers will be given weekly and monthly expenses details. It is not clear now when and how it will be available in other countries except the United States.