Softbank recently suffered huge losses on investing in We work. Softbank has also invested in Paytm as well. As Paytm shifts to its investors for funds to take on competition from PhonePe and Google Pay, it’s the most prominent investor SoftBank is now insisting on an IPO within the next 5 years. While SoftBank has elected to sign the deal for the new fund’s immersion. One of its requirements is that Paytm should have to go public in the next 5 years.

The terms and conditions for investment by Softbank are also very crucial. It states that if Paytm is not successful in going public in the next 5 years then SoftBank is liable to sell its 19% stake to other investors. The other investors may or may not be Paytm’s current rivals. SoftBank assumes that Paytm has arrived at a point where terms and conditions can be added.

As Paytm is currently facing huge losses, SoftBank is looking to ensure that the firm is not getting bankrupt like WeWork. Listing terms and conditions are usually comprehended in phases and protocols set for growth and late-stage rounds, most frequently to ensure the profit of the business. Paytm recorded a huge net loss of INR 4,217 Cr in the financial year 2019, ending in March 2019. Whereas in Financial year 18, its net loss was at INR 1,604 Cr.

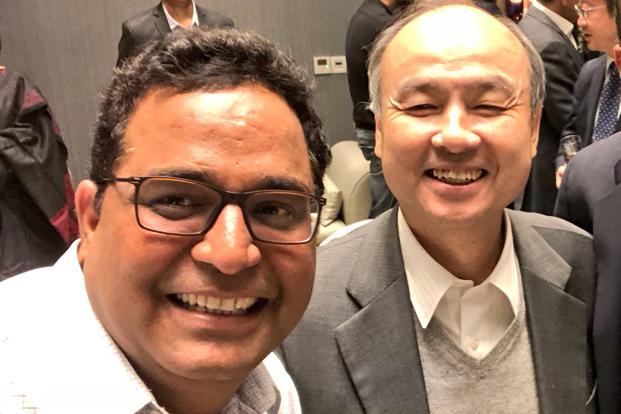

It is also worth mentioning that Softbank’s CEO, Masayoshi Son, who was wicked for demanding firms to progress as fast as feasible, recently told portfolio firms to try to “be successful”, because of the unrestricted market wouldn’t stand gimmicks. This statement can also be given due to its faulty deal in we-work.