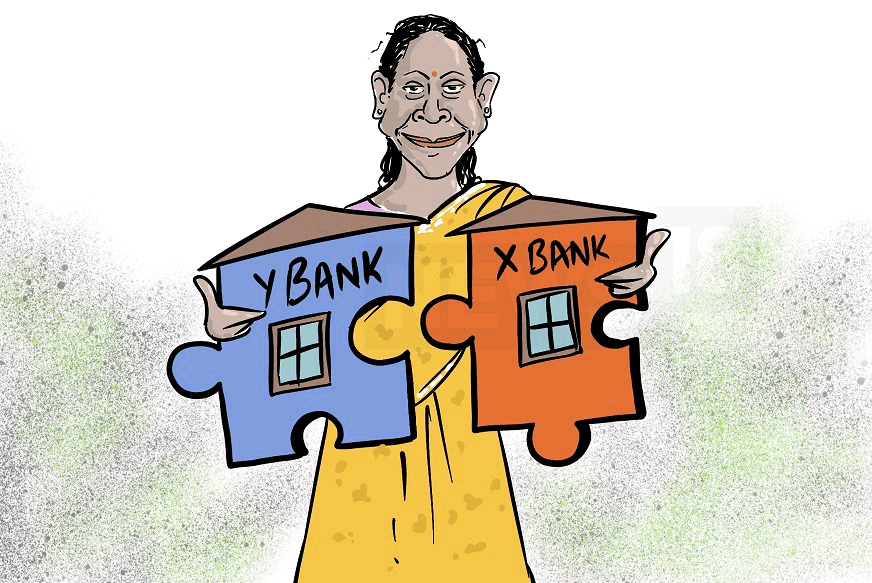

The Union Cabinet has approved the merger of 10 banks of the country. Finance Minister Nirmala Sitharaman has announced that ten public sector banks (PSBs) will get merged to form four big banks. This decision hasn’t gone well with the bank employees as they consider it to be an illogical step. Therefore bank employees all over India will protest against this big step on April 1 2020.

Two major unions in the banking sector, All India Bank Employees Association (AIBEA) and All India Bank Officers Association (AIBOA) have called for a strike on April 1. These unions have called this strike in protest against the absurd mega bank merger process. However, this mega bank merger will be effective from April 1, 2020. The Finance Ministry announced this mega bank merger on August 30 last year.

Only 12 Public Banks Will Be Left After Mega Merger Plan

From April 1, Punjab National Bank will merge with Oriental Bank of Commerce and United Bank of India. At the same time, Andhra Bank and Corporation Bank will merge with Union Bank of India. Apart from this, Allahabad Bank will get merged with Syndicate Bank, Canara Bank and Indian Bank. After this mega-merger of banks, the number of public sector banks will become 12. Three years ago, this count was 27.

Regarding the merger of banks, the government believes that this will increase their risk-taking ability. According to the government, discipline in banks will increase, the competition will increase, and their ability to give loans will also increase.

However, according to the experts, at this fatal time of economic crisis, this step will only deteriorate the banking process. AIBEA General Secretary CH Venkatachalam stated, ‘Can anyone say that the merger of banks will lead to the recovery of such a large corporate bad loan? We have seen that after the merger of State Bank of India (SBI), its bad loan rate has increased. Now the same danger will be with these banks which are about to get merged.

Merging Banks A Good Idea?

In the past few months, India witnessed a rise in the unfortunate situation of the banking sector. Earlier PMC bank was banned for its services, and now YES bank is also in this critical situation. The RBI has prohibited Yes Bank from providing services for a month. Due to this ban, customers of Yes bank will not be able to withdraw more than 50000 rupees monthly. The main challenge is the banks with relatively high NPAs are being merged with an entity that is not in the best condition. This scenario can make banks in a more complicated situation, and situations like PMC and Yes Bank can rise again in future with other banks.